Beyond Hyperbole

Diane M. Grassi provides public policy analysis on today's topical issues, given short-shrift by the mainstream media, with a factual context, understandable by all. She also takes on the sports world's role in America both economically and legally, with a special interest in Major League Baseball. Diane will have you coming back time and again. Her goal in mind is to awaken you to the issues. And you can take it from there.

Tuesday, March 31, 2015

Thursday, March 26, 2015

MORE THAN DOUBLE STANDARD FOR WINTER OLYMPICS ATHLETES

By Diane M. Grassi

Big media and corporate sponsorship of sporting events in the United States have become as big a story these days as the sports and athletes they themselves sponsor, with nary an opportunity missed by advertisers and networks alike to promote themselves. Whether it is the National Football League, Major League Baseball, the National Basketball Association, the National Hockey League, the National Collegiate Athletics Association, or the United States Olympics teams, the broadcasting rights and contracts and their respective advertising dollars rule. But unfortunately, how individual sports and their respective athletes are treated by such entities varies, and especially if the athlete is on the U.S. Winter Olympics team.

There are a bevy of ironies which most sports fans are aware of when it comes to “non-professional” athletes and teams. For starters, the Winter Olympics is not given the gravitas that the Summer Olympic Games enjoy every four years. In fact, most American spectator-sports fans are hardly cognizant that the 2006 Winter Olympics’ Opening Ceremonies are set for February 10, 2006 in Torino, Italy, a mere five days following the NFL’s Super Bowl XL.

These days the Super Bowl trumps all other sports for television viewership in the U.S., although not historically. And we cannot blame the failure of promoting the Winter Olympics and its respective sports on the success of the NFL. However, we can be critical of the non-existent coverage, for example, of World Cup skiing since the 2002 Winter Olympics, and arguably the most broadly appealing event of the Winter Games, as a truly competitive sport, maybe with the exception of ice hockey. After all, people in the U.S. do ski. And even though figure skating is a big draw, we all know that it is more a presentation that an athletic competition. And how many of us go on curling vacations?

Years ago, the World Championships for skiing were featured on broadcast television, namely on ABC Sports. Nowadays, sports fans are lucky if they happen to catch it on the obscure cable television network, Outdoor Life, which on occasion and inconsistently provides taped coverage of the U.S. Ski Team, usually a week to ten days even after the event has taken place. What a great way to promote interest!

Then, we have the hypocrisy of the U.S. Olympic Ski Team and the United States Olympics Committee which wants to have it both ways. They need the television coverage and sponsors and expect their athletes to tow the party line in being “part of the team.” However, virtually almost all the Olympic athletes compete as individuals.

There is also the rub that the American people do not have the appetite for winter sports. But with little exposure but every four years but for two weeks of coverage, you cannot blame the fans. On top of that the USOC expects the U.S. Olympic team to display exceptional behavior above and beyond those in the professional sports community, since its athletes represent the U.S. on the world’s stage. Others argue that an Olympian should not be treated any differently than say U.S. tennis champion, Andy Roddick, who competes for the World Tennis Association or even golfer, Tiger Woods, when competing in Professional Golfers Association events.

That brings us to the latest media frenzy regarding 2005 World Cup Skiing Champion, Bode Miller. For those of us who have more than a five-minute memory, you may recall that Miller won two silver medals during the 2002 Winter Olympics in Salt Lake City, UT. In fact, television ratings and American awareness of the Winter Olympics are said to have surpassed expectations in 2002, because the Games were held just months after the September 11, 2001 attack on the U.S., and the Olympics offered an opportunity for Americans to “heal.” Therefore, those who normally would not watch the Winter Olympics did and Bode Miller was one of the feel-good stories of the Games.

Bode Miller was not expected to medal in 2002 and walked off with the silver in both the alpine combined and giant slalom races. He nearly fell down during the course of one of his races but still managed to finish second. Miller was hardly a lost story of the 2002 Winter Games. But for those potential new fans which could have come aboard since or those of us who would have liked to follow Miller’s career since, we have been locked out.

In 2005, Miller spent 250 days on the road competing nearly six months predominantly in Europe, where he is far better known. He became the first American skier in 22 years to win the overall World Cup Skiing Championship title. He competed in all four alpine skiing disciplines on the slopes which includes the downhill, the slalom, the giant slalom, the Super-G and the combined, which is one downhill run followed by two slalom runs. If you tried really hard you perhaps heard about it by seeing it on the internet or deeply buried in your favorite sports section.

But on January 8, 2006, infotainment television show, “60-Minutes,” once heralded as the best news magazine program on television, featured an interview piece with Bode Miller by Bob Simon. Unfortunately, “60 Minutes” chose to go the way of most tabloids these days by emphasizing Miller’s controversial remarks concerning tying one on after ski races and then having to pay the price the next day, in addition to his criticism about the drug testing system for World Cup athletes by the U.S. Anti-Doping Agency. It presented a rather skewed look at Miller, but according to the sports media has now put the Winter Olympics back on the map and that now Americans will finally start caring about winter sports. Hopefully, most sports fans find that rather insulting, along with the piece by “60 Minutes,” which has become so desperate for TV ratings these days they have stooped to the level of tabloid journalism.

The broadcast networks and the USOC underestimate the sophistication of the American viewing public. We are fed a daily diet of indiscretions and inappropriate behavior including felonies committed by both professional and college athletes. Most fans do not like it, but accept it and even give athletes the benefit of the doubt, while others sadly have just become numb to such activities. But now we have a World Champion athlete, given nearly no positive coverage for four years, and he mentions that he goes out and downs a few cool ones after his ski races and we are supposed to be shocked and outraged. Yet, we are also expected to care deeply because he is on the U.S. Winter Olympics team headed for Torino and must hold him to a higher standard.

Confused yet? The truth is, Bode Miller, not unlike a lot of athletes, does not conform to some of what his coaches say, and even chooses to travel apart from the team. He trains on his own as well and since he entered the World Cup circuit in 2001 has never been one to keep his yap shut. So what’s this all about anyway? Sounds like the quickest way to stir up interest for the Winter Olympics is to create controversy. In fact, it’s a lot cheaper for the USOC and Winter Olympics broadcast host, NBC, to fuel such stories. Instead of raising awareness of lesser known athletes deserving of attention, make sure to get them in the news every four years, any way you can, even it is at the expense of their achievements.

Friday, July 23, 2010

A GLOVE OF THEIR OWN

By Diane M. Grassi

By Diane M. GrassiThe recession of 2008, long documented as the worst economic crisis since the Great Depression, has impacted not only Wall Street and the American pocketbook, but the American psyche.

As such, there has been a symptomatic withdrawal not only by the American consumer, but by the American family and thus, by extension, the American neighborhood. And such has left many communities unengaged and in a state of bewilderment, with others steeped within the depths of despair.

It is in such times of crisis that the national fabric becomes torn and many feel displaced and disconnected. Yet, there remain some select individuals who take it upon themselves to offer hope, in helping to present a new paradigm for a collective morale boost, by uniting families with neighborhoods, and in helping to reconnect those neighborhoods with their respective communities; revisiting those values once identified as the essence of the American spirit.

And in that effort, a unique “movement” is evolving by way of a New Jersey father, most proud of his two children, and outwardly dedicated to reaching out to all children, in order that they too may continue to pass on the once held dear concept of “giving back”, as they become adults and raise children of their own. And Salomon and his wife do no less with their own two youngsters.

Bob Salomon is a name you will be hearing about. He is using the concept of children participating in sports as the vehicle to communicate his all encompassing goal of giving back. His first effort has evolved through the game of baseball. More specifically, the illustrated children’s book, A Glove of Their Own, published in November 2008, has caught fire and is the centerpiece of Salomon’s main vision.

The story is about a group of youngsters playing a pick-up game of baseball on a local neighborhood lot. Unfortunately, not all have bats and gloves to properly play the game. But a retired gentleman comes across them playing, only to return another day with a duffle bag filled with used gloves, bats and balls from games gone by, used by his own children. He then donates them all to the group of children. It but sets a good example for the children and serves to inspire them to keep on playing the game they love.

As a direct result of brainstorming with two friends, the eventual co-authors of A Glove of Their Own,

Debbie Moldovan, Keri Conkling and Lisa Funari-Willever, Salomon was presented a written story, and later beautifully illustrated by Lauren Lambiase and published by Franklin Mason Press.

But it was Salomon’s tenacity that convinced Funari-Willever, also Franklin Mason’s publisher, to see his project through, assuring her that she would not regret her involvement. Funari-Willever, herself, has dedicated much of her life to giving back and was the main force behind Salomon’s now realized proposition.

The end result of this collaborative effort was not just that of publishing a nice children’s story, but an extended benefit from it arose. It would serve as an example for children to be forthright, unselfish, giving and grateful. But equally important to Salomon, is that children are reminded to have fun while playing the game of baseball, and all sports, and to point out that just being a kid is okay, too.

Yet, it was only through A Glove of Their Own that Salomon realized his deep-felt obligation to become a facilitator of charitable efforts, not only by continuing to publish children’s sports stories, but by reaching out to a variety of organizations and media entities as well.

The intent is to pique the interest of professional athletes, professional sports franchises, sports-affiliated businesses, community invested corporations, and non-profit agencies, amongst others. And Salomon hopes to meld various partnerships to approach communities. These communities would then become their own facilitators with the intended goal of encouraging children’s participation in extra-curricular organized sports, funded by a combination of various entities and manifesting fundraisers nationwide.

However, the underlying theme, which Salomon insists must remain, is that professional athletes, both active and now retired, start making more of an investment in their local communities in which they play or in which they reside.

And it would behoove these professional athletes, and those now retired from professional play, to become involved on their own accord, rather than, for example, through a required clause in their playing contracts to perform volunteer work, which many Major League Baseball (MLB), National Football League (NFL), National Basketball Association (NBA) and National Hockey League (NHL) professional teams now require as part of player negotiated deals.

Charity is but a gift and giving back should ultimately come from the heart. And Salomon truly believes that children will see through those athletes who are merely going through the motions, thereby not setting a good example for them. He wants to work with those who are dedicated in their intent to reach out to the children in the community, and simply because it is the right thing to do, rather than to garner accolades for themselves.

At such a time when discretionary income is dangerously low nationwide, it is imperative that municipalities, local communities, schools and neighborhoods alike, come together in innovative ways to mobilize future generations to continue to thrive; to return the favors bestowed upon them by enjoining the public with the private sector to a positive end.

Salomon has duly impressed many already in the private sector such as Rich Lampmann, Director of Promotions and Public Relations of Modell’s Sporting Goods. “The memories of the pick-up games in the yard or at the field, stick with us for a lifetime. Bob and his team have taken this a step further and are not only promoting the game…but also using the games as a means of spreading sportsmanship and teamwork for the greater good.”

And Rick Redman, Vice President of Corporate Communications for the Louisville Slugger Museum and Factory notes, “It’s a wonderful story that everyone can learn from; kids and adults. Plus, it’s tied to many great causes and provides the chance to donate funds to your favorite baseball charity. How could we say no to Bob Salomon? He has a drive and passion that’s unmatched.”

There also are many retired athletes who have leant their support to A Glove of Their Own such as former MLB players Craig Biggio, Bernie Williams, Sean Casey, Jason Grilli, Tommy John, Roy White, Phil Niekro, Bud Harrelson, current Los Angeles Dodgers manager, Joe Torre, former Yankee great Yogi Berra and the Yogi Berra Museum and Learning Center, and many others.

And Bob Salomon hopes to collaborate with active MLB players such as Joe Mauer, starting catcher for the Minnesota Twins, and Nick Swisher, the right fielder for the New York Yankees. Both players are dedicated philanthropists in their own right, making giving back through charity a priority in their lives off the field. And there are a bevy of many well intentioned athletes in the NFL, NBA and NHL who Salomon continually reaches out to in hopes of being afforded the opportunity to meet with them on future charitable endeavors.

Salomon is also involved in a collaborative effort with former MLB pitcher, Tommy John, as a producer of a film documentary. It will feature John’s life and center on the now worldwide famous Tommy John Surgery now considered the state-of-the-art corrective surgical procedure for injured elbows, based upon John’s own surgery decades ago. It not only saved John’s career but has extended the careers of countless other players, not only in MLB, but throughout professional and amateur sports.

Those wishing to learn more about A Glove of Their Own can visit its website, agloveoftheirown.com where

one can learn more about all of its affiliated organizations, including corporations, broadcast media outlets, non-profit agencies and other athletes and celebrities touched by the spirit of giving.

And Salomon also wants to ensure that individuals can play a participatory role in whatever way they choose, in order to give back. It does not necessarily have to be on a grand scale or with relationship to an agency or corporate interest, either. Any small acts of kindness and involvement in neighborhoods and communities is the intent of Salomon’s purpose. Or folks may choose to go the route of purchasing copies of A Glove of Their Own and rallying others to participate in that way as well.

As such, books may be purchased through either agloveoftheirown.com or through franklinmasonpress.com. Franklin Mason Press donates $.10 from the sale of each book to the following organizations: Good Sports, Sports Gift, and Pitch in for Baseball. In addition, $3.00 per sold book will be given to any school or non-profit organization that joins Salomon’s effort.

His immediate next project is to publish a children’s book involving football as the theme, this time. But again, his effort is far more than a hyped up version of pay it forward, and rather a rallying cry to nurture our children. In doing so, we will all be better human beings for it will serve to enrich the quality of all of our lives, both locally and nationally, for decades to come. And that should be a priority for all of us.

“Success is not the place one arrives, but rather the spirit with which one undertakes and continues the journey.” – Alex Noble

MLB'S Gaming Sale of Texas Rangers Continues

– MLB Commissioner, Bud Selig – July 12, 2010

As this reporter documented here in May 2010, the still impending sale of Major League Baseball’s (MLB) Texas Rangers has suffered no shortage of legal and financial machinations and maneuvers, including political manipulation, for many, many months. Yet, it has been nearly a year and a half since Texas Rangers owner, Tom Hicks, defaulted on a $525 million loan in March 2009, eventually ending up in bankruptcy.

Unfortunately to date, the sale of the Rangers still awaits finalization and most importantly, the investment group to be awarded the final sale of the club has yet to be determined by the U.S. Bankruptcy Court and ultimately to be approved by MLB and its respective owners.

But Mr. Selig’s above referenced recent quote indicates that despite the length of time and resources expended by the U.S. Bankruptcy Court, and the hundreds of millions of dollars at stake for the Rangers’ numerous creditors, Bud Selig will fight all obstacles in securing the group he sees fit to own and run the Texas Rangers; namely the Greenberg-Ryan Group. It is comprised of Pittsburgh sports attorney, Chuck Greenberg and present Texas Rangers president and minor league team owner, Nolan Ryan and their entity, Rangers Baseball Express, LLC.

It unfortunately takes far more than a good score keeper to not only understand but to keep track of all of the twists and turns in this case, Texas Rangers Baseball Partners, 1043400, U.S. Bankruptcy Court, Northern District of Texas, (Fort Worth), even since May 2010.

The upshot is that there will be an auction in U.S. Bankruptcy Court on August 4, 2010. However, prior to that date on July 22, 2010, the Rangers shall emerge from Chapter 11 Bankruptcy Protection, initiated on May 24, 2010. At that hearing, U.S. Bankruptcy Court Judge D. Michael Lynn will hold the Ranger’s reorganization confirmation hearing.

Additionally, Judge Lynn will hear complaints on July 20, 2010, regarding new auction rules for the August 4th date. It concerns creditors’ issues primarily due to MLB’s acceptance of the lowest of the three bids previously offered for the Rangers, and its clear preference to award the club to Greenberg-Ryan.

The two previous higher bids were from former sports agent, Dennis Gilbert in collaboration with Dallas businessman, Jeff Beck and the other came from Houston businessman, Jim Crane.

Crane, whose bid was the highest, backed through lender, J.P. Morgan Chase & Co., previously filed a motion with the U.S. Bankruptcy Court stating that MLB deliberately blocked his negotiations with the Texas Rangers. In fact, Selig wrote an April 30, 2010 letter to J. P. Morgan Chase & Co. in response to that motion, reiterating his “best interests of baseball” motives, in his attempt to diffuse the matter; albeit unsuccessfully.

And since creditors are owed approximately $576 million on first and second-lien debt, that includes interest, by Tom Hicks’ HSG Sports Group, LLC, they want every opportunity to be given the best chance to recoup their losses.

However, an 11th hour wrinkle has also emerged, which perhaps may be the best resolution of all; according to various financial experts, legal representatives, sports industry analysts and many involved with some business facet of MLB.

And that magic bullet would be none other than Dallas Mavericks owner, Mark Cuban. Cuban made a bid for the Chicago Cubs three years ago, when it was up for sale by the Tribune Co. At that time speculation surfaced that Cuban’s brash outspokenness and aggressive management style would clash with that of MLB’s.

It seems pretty ironic now, given that a former MLB owner, one George M. Steinbrenner, who was eulogized this past week, was but praised for having some of those very same qualities, which Cuban seems to also behold.

Mark Cuban’s recent interest in the past couple of weeks in the Texas Rangers is especially intriguing in that he may have interest in placing his own bid before the August 3, 2010 deadline for acceptance of bids for the August 4th auction.

Or, Cuban may ask to become just one of the investors of a group, by supplementing the capital of one of the other investment group’s bid, since the new auction guidelines require that to qualify a bid must now clear the Greenberg-Ryan bid by $20 million.

Cuban recently stated, “With some of the court rulings, it’s changed the economics of everything…I wanted to make sure that I was at the table, just in case.…I’m hoping I’m more of a backstop than anything else.”

It would be hard to believe that Mark Cuban would want to be anyone’s backstop, no more so than would George Steinbrenner.

But one thing is more certain in this whole messy scenario as concerns the sale of the Texas Rangers and that is that there will be no lack of drama and last minute antics by all parties involved; especially given Cuban’s entry into the fray and just under the wire.

And if U.S. Bankruptcy Judge Lynn still has anything to say about it he said plenty when asked on July 12, 2010 about Bud Selig’s public remarks about his preference for the Greenberg-Ryan bid, “I don’t believe MLB can frustrate this process any longer.” Hopefully Judge Lynn is right, this time.

Once again, stay tuned…

Copyright ©2010 Diane M. Grassi

Contact: dgrassi@cox.net

MLB'S Gaming Sale of Texas Rangers

And just a dozen years after the sale of the Rangers by Bush and his investors in 1998, the Texas Rangers organization is again immersed in financial wheeling and dealing, with an upside down ledger. For its expected imminent sale by owner, Thomas O. Hicks, has been met by a major snag from both his creditors and Major League Baseball (MLB), which has injected itself into the middle, with its purported takeover of the Rangers in the very near future.

Should MLB proceed to seize the club, it could be facing an involuntary bankruptcy by creditors, and tied up in court indefinitely while owners of MLB’s 29 other clubs incur the cost of operations of the Rangers. But that prospect does not seem to deter MLB commissioner, Bud Allen Selig, as he believes that MLB’s taking control of the Rangers will offset any bankruptcy proceedings; but another gamble.

But in order to fully appreciate the present predicament of a franchise that has mightily underachieved since arriving in Texas in 1972, from Washington as the Senators, and reaching the post-season only 3 times since, it is worth retracing some highlights of how the Rangers wound up in such a mess.

George W. Bush, with the help of then-commissioner of MLB, Peter Ueberroth, gathered a group of wealthy Texas investors who had political and business connections to his father, then-president of the U.S., George H.W. Bush. In 1989, George W. Bush initially invested his $106,302.00 for a 1.8% stake in the club and later took out a $500,000.00 loan to up his ante to a total of $606,302.00, increasing his interest to 11.8% in the Rangers. While the club eventually sold in 1998 for $250 million, Bush and his investors’ purchase price was a cool $25 million.

In short order, plans for a new stadium were under way, financed completely by Arlington taxpayers, including a surcharge on game tickets and state tax exemptions, totaling over $200 million. And all profits went directly back to the owners.

By the time the Rangers Ballpark in Arlington was opened in 1994, George W. Bush was nearly governor of Texas, as he put his assets into a blind trust, with his interest in the Rangers being the exception.

The upshot being that for his original $606,302.00 investment, George W. Bush got a 25-fold return on his original investment, clearing a $15 million profit. And such got him the capital and gravitas he curried for his run to the White House.

Enter billionaire, Tom Hicks, co-founder and CEO of Hicks, Muse, Tate & First, Inc. from 1989 to 2004, a nationally prominent private equity firm specializing in leveraged acquisitions, including multi-media broadcast entities, banks and real estate. And it was the Hicks Sports Group, LLC of HMTF that purchased the Texas Rangers Baseball Club in 1998 for that $250 million.

Hicks also purchased the National Hockey League’s (NHL) Dallas Stars Hockey Club in 1996, which went on to win a Stanley Cup Championship in 1999. Since then Hicks has been noted for his controversial purchase of a 50% interest in the Liverpool Football Club, an English Premiership League team known as “Britain’s Most Successful Football Club”, purchased in 2007 and much to the dismay of British fans.

Similarly to the Rangers, Hick’s is selling his interest in these other franchises as well. He wants double the price he paid for the Liverpool club and is currently working with NHL commissioner, Gary Bettman, on the sale of the Stars.

But the sale of the Rangers has proven to be far dicier. Bud Selig and MLB have far more to worry about, however, than Tom Hicks at this point, as MLB is now the intermediary in the ongoing negotiations with prospective buyers of as well as the Texas Rangers’ creditors. But a $525 million loan default, threats of court decisions from potential litigation, bankruptcy and the future fiscal health of the team that includes keeping it afloat, will rest with MLB.

What’s next? MLB taking over the Los Angeles Dodgers, while its owners, Frank and Jamie McCourt duke out their divorce decree?

Yet, MLB makes no apology for its policy of sequestering its own books from both the Major League Baseball Players Association (MLBPA) and the public-at-large. For MLB to hold itself in higher regard than Tom Hicks, an evident capitalist who pushed the envelope only as far as his creditors would allow, and at the time with the blessings of MLB, is but the height of arrogance.

However, MLB has invoked its “not in the best interests of baseball” rule, by virtue of the commissioner’s charter, as reason to interfere with the proposed sale of the Texas Rangers. And in that effort, it is willing to accept the least lucrative bid made for the club’s purchase. MLB is determined to guarantee that the Greenberg-Ryan Investment Group which includes Rangers’ president, Nolan Ryan, will ultimately become the eventual owner, in spite of two legitimate and higher bids that were made.

But the “not in the best interests of baseball” rule is a reach at best, given the challenges that MLB will embark upon such as with Monarch Alternative Capital, which has a 57% interest in the Rangers’ debt along with 40 other creditors’ liens against the Rangers, that includes the CIT Group, Inc. They want to make good on the sale of the team in order to recoup their losses and have no fear of tying up the sale in court no matter how long it takes.

And it is there that the rub begins for Bud Selig, who himself appropriated more than $25 million in MLB loans to the Rangers in 2009, $16 million of which went to salaries alone, to keep the Rangers going until June 2010. And since 2009, MLB has embedded itself in Rangers’ management decisions. For example, 1st-round 2009 draft pick, starting pitcher Matt Purke, declined the Rangers’ market value offer and opted to attend Texas Christian University instead, as it was reported that MLB would not permit the Rangers to tender an offer to him for more than the minimum ‘slot system’ specifies, in order to sign him.

If there is no resolution by creditors or a closing date set for the sale of the team soon, this June too could put salaries and bonuses for MLB draftees as well as projected trades for the July 31st trade deadline in jeopardy, as well as put the future of the Texas Rangers franchise in peril for years to come.

MLB and Bud Selig calling all of the shots by fiat presents a clear conflict of interest in terms of the free marketplace. And clearly this is but a bailout by MLB with ramifications similar to those of the U.S. federal government in bailing out financial institutions, car manufacturers and insurance companies. Not only does the government incur a financial stake in these companies but is but purchasing the right to dictate corporate policy. And MLB is no different in that regard in this case.

Yet, on its face, the intricacies are more far reaching than MLB’s takeover of the then Montreal Expos in 2004, now the Washington Nationals. In this matter, after the layers are peeled back, we can see that the “not in the best interests of baseball” rule does not necessarily include taking on Wall Street brokerages, the multi-national banking industry and the U.S. Bankruptcy Court, all the while showing favoritism towards a specific group that wishes to purchase the team.

Volumes have thus far been written over the past year concerning an over-leveraged Tom Hicks. Yet, the same can be said of the entire U.S. economy and its players from Wall Street to Capitol Hill. While that is no excuse for alleged corporate malfeasance, with respect to MLB, cooler heads should prevail. And sometimes that should actually mean that the integrity of the game stands for something other than its bottom line.

In light of the Rangers’ 87-75 2009 win-loss record, far better than in years past, it would be a shame for the hopes and talents of some of its young players to be squandered by reckless decisions on behalf of Bud Selig and MLB. And hopefully, the remaining MLB owners will weigh in and fall on the side of common sense. Stay tuned.

Copyright ©2010 Diane M. Grassi

Contact: dgrassi@cox.net

Thursday, May 27, 2010

STATES RUSH TO LEGALIZE SPORTS BETTING & EXPAND GAMBLING FOR REVENUE

By Diane M. Grassi

With the melt down of the global economy over the past 2 years, multi-national brokerage firms and trusted financial institutions bore the brunt of accusations of gambling away the financial health and futures of investors, primarily through the sale of toxic mortgages with credit default swaps as the vehicle in doing so.

Yet, it is the mainstreaming of gambling on many levels that has created a culture whereby it has become an acceptable norm for not only corporations but governments in the United States, on both the federal and state levels, to literally invest in the gambling industry, with the recession as the excuse for its necessity.

Yet, for years prior to the current recession, brokerage firms such as Goldman Sachs & Co., Merrill Lynch & Co. and Fidelity Investments were already investing their clients’ stocks and mutual fund portfolios, in financing offshore casinos.

The question remains as to whether they skirted U.S. federal law, which prohibits offshore online gambling for Americans, as well as to whether they made reliable investments on behalf of their clients, many of whom remain unaware that such financial instruments are involved in such volatile industries. So, Wall Street was already in on the game.

Fast forward to 2010, where many U.S. states are on the precipice of bankruptcy and are desperate for that magic bullet to increase tax revenues without continually cutting services for their already over-taxed residents. And to that end, many state governors and state legislators are clamoring to push through laws in anticipation of overturning the federal law in place, prohibiting sports betting on both professional and amateur sports, otherwise known as the Professional and Amateur Sports Protection Act of 1992 (28 U.S.C. §3701) (PASPA).

To wit, the state legislature of New Jersey passed State Resolution No. 19 on January 12, 2010, which authorizes its President of the Senate to “take legal action concerning certain federal legislation prohibiting sports betting.” It would repeal the federal ban on sports betting, in all other U.S. states, with the exception of Nevada, Delaware, Oregon and Montana, already permitted to offer parlay-type sports betting. Nevada, however, exclusively enjoys all types of sports betting, statewide, on any professional or amateur sports games, in any capacity.

Basically, New Jersey, and specifically Senator Raymond Lesniak, who originally launched a lawsuit on his own in March 2009 against the federal government, claims that the 1992 law violates the 10th and 14th Amendments to the U.S. Constitution, in that “It establishes a selective prohibition on sports betting in the U.S.” The argument is that it violates the 10th Amendment to the United States Constitution by regulating a matter that is reserved to the States. And that it violates the 14th Amendment to the United States Constitution by being unconstitutionally discriminatory against the Plaintiffs and the people of the State of New Jersey.

Lesniak’s case presently resides in the U.S District Court, District of New Jersey, seeking declaratory relief. But the upshot is that New Jersey believes that it “Would benefit significantly from lifting the federal ban and legalizing sports betting in this state, as increased revenues would be generated and numerous jobs would be created for New Jersey residents as a result of sports betting activities at Atlantic City casinos and New Jersey’s racetracks, further enhancing tourism and economic growth,” according to Resolution No. 19.

Prior to PASPA, the Wire Act was enacted in 1961. It was intended exclusively for prohibiting the placement of bets by telephone to bookmakers for sporting events, and was largely put in place by then U.S. Attorney General, Robert F. Kennedy, in order to discourage organized crime and bookmaking. But gaming and its technology has come light years since 1961, and it would appear that the Wire Act’s shelf life has thus expired.

Meanwhile, in the U.S. Congress, House Representative Barney Frank (D-MA), Chairman of the House Financial Services Committee, has promoted a federal resolution to legalize and regulate the internet gambling industry in the U.S. (H.R. 2667). That proposal falls on the heels of the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA). It proscribes that offshore internet gambling is a violation of federal law.

Furthermore, legislation was passed by the New Jersey legislature in its state Senate to amend the New Jersey State Constitution, allowing legalized sports betting, which the New Jersey voters would ultimately vote on in a referendum as early November 2010.

But this constant back and forth between drafting new law and upholding existing legislation on a federal level to regulate gaming, runs in direct conflict with those states introducing new laws, geared to open up the flood gates for a variety of legalized gaming platforms, including sports betting. In addition, the National Indian Gaming Association, with respect to state Indian gaming contracts, originally authorized by the U.S. federal government, presents other conflicts on both state and federal levels.

Therefore, with the rights of gamblers continually in flux, the question must be asked what about the rights of non-gamblers and the resources that will be expended towards the downside that accompanies a gambling culture, upon which states will necessarily become dependent?

In the state of Nevada alone, with unemployment approaching 23%, for those presently receiving extended unemployment benefits as well as those no longer receiving such benefits, it is the gaming industry specifically that is responsible for such a jobs freefall which accompanies a nearly $1 billion state budget shortfall. Add to that the highest mortgage foreclosure rates in the entire U.S. and there arises a recipe for disaster.

And as gaming drives all other industry including construction, conventions and tourism, primarily in Las Vegas, it would make one wonder what other state officials are thinking when gaming revenues in Las Vegas went down over 20% between 2008 and 2009, and it has yet to come out of its funk.

Las Vegas Strip properties’ construction is at a virtual standstill with over leveraged multi-national conglomerates also reeling from the worldwide mortgage crisis. It appears that it was not only the little guys at the slot machines who gambled with their fortunes over the past few years.

With respect to sports betting on the National Football League’s (NFL) Super Bowl, Las Vegas betting revenues for the past 2 seasons of 2008 and 2009 were down considerably from years past. Nevada casino sports books in 2008 lost $2.6 million on the Super Bowl and in 2010 a total of $82.7 million was wagered with a net gain of only $179,000.00 more for casino sports books than in 2009. In contrast, $94.6 million was wagered in 2006, prior to the recession.

Yet, New Jersey is convinced and presupposes that sports wagering will generate hundreds of millions of dollars in state revenue over the course of a 5 year period, for its state alone. And it remains dedicated to also expand casino gambling in spite of its own realized massive decline in profits over the past 2 years.

But the state of New Jersey is hardly alone in its desire to gamble on gambling with many states introducing legislation and campaigning for both intrastate and interstate forms of gambling, both online and throughout casinos and racetrack locales throughout the U.S.

Currently, 48 states enjoy some form of legalized gambling and/or state lotteries, with the exception of Hawaii and Utah which do not presently permit any type of gambling, wagering or lotteries. However, Hawaii is presently weighing legislation for a stand-alone casino in Waikiki.

States in addition to New Jersey proposing sports betting and some type of expansion of casino gambling, including online gaming, with some states already preparing such legislation regarding sports betting in the event that PASPA is overturned includes: Iowa, Delaware, Massachusetts, California, Texas, Alabama, Missouri, Georgia, Florida, Pennsylvania, Indiana, Maine, New Hampshire, Connecticut, , Michigan, Kentucky, Illinois, amongst others.

In the case of Delaware it won the right in 2009 to offer 3-game parlay style sports betting at its 3 racetracks or racinos for NFL games only, as states that previously offered lottery style or legalized sports betting from 1976-1990 were exempt from PASPA. Yet, after its well fought challenge in federal court in 2009 for Delaware to be permitted to bet on all professional sports a la Las Vegas style without restrictions, it was defeated. But Delaware has not yet given up its fight and its case has been appealed to the U.S. Supreme Court.

Iowa is also leading the charge in crafting legislation to allow legalized sports betting. However, Iowa State Senator, Jerry Behn (R-Boone), thinks that gambling is a “Tax on the people who can afford it the least.” Yet, his colleague, State Senator, Jack Kibbie (D-Emmetsburg), on betting on professional sports says, “People say I would love to do what they can do in Las Vegas.”

Perhaps those with the same sentiments as those of Senator Kibbie will not be so game, so to speak, when there remains little discretionary income for such sin taxes to generate anticipated windfall profits.

With respect to California’s new plan there comes an additional rub. It plans to introduce an online gaming network. Yet, it potentially could be in violation of Indian Gaming licenses or compact agreements that California entered into in 1999 with Native American tribes in its state. The compacts gave the tribes exclusive rights to any gambling that involved gaming devices including slot machines, roulette tables and video poker machines, etc.

Furthermore, it took 5 years for California to get the tribes to honor the payment of taxes due to the state of California by virtue of the compacts. The tribes withheld tax payments until 2004, of which some were retroactively paid. However, the state of California still gives such exclusive rights to the Indian tribes through 2030, which remains a binding agreement to date.

Now, the California tribes have threatened to once again withhold paying the government of California its share of taxes due for gaming revenues, should California proceed with its online poker network plans. The state’s position is that the compacts do not include poker and cover only games of chance. Yet, the tribal councils deem gaming devices to include computers used for online gaming, and thus negating California’s plan.

Such a dust-up could resonate through the Native American community, with its 442 tribal casinos operated by 237 tribal governments and Alaska native villages in 28 states. Revenues translate into a nearly $30 billion a year industry for them.

And Congressman Frank’s legislation to regulate internet poker would also be a direct threat to Indian gaming casinos, unless the Indian Gaming Regulatory Act of 1988 is somehow amended.

Ideally, California wants its poker network to go nationwide, raising revenues by ultimately licensing interstate networks and thereby generating additional profits through the ownership of such various licenses between states. The hope is that it could eventually trump PASPA.

Everything is politics, it would seem. But complicated legislative loopholes aside, basing entire economies – and California’s alone is the six largest in the entire world – on games of chance is quite the risky proposition itself.

And how taxpayers can be expected to trust their state governments to invest in struggling enterprises, already in the red, in order to prop up their cash-strapped states, many nearing junk-bond status due to irresponsible governing, remains the $64,000.00 question.

Time was when Vegas thought gambling was recession proof. And there should be little doubt that Las Vegas now serves as the poster child for that which results when gamblers stop gambling and traveling to destination resorts.

And for public officials to abandon all reason and principles, looking for a quick fix, rather than by relying upon ingenuity for the creation of jobs and revenue outside of the gambling sector, could very well come back to bite them, in the end.

Copyright ©2010 Diane M. Grassi

Contact: dgrassi@cox.net

ROGUE COMMISSIONER: The NBA's David Stern

“Considering the fact that so many state governments – probably between 40 and 50 – don’t consider it immoral, I don’t think that anyone should. It may be a little immoral because in reality it is a tax on the poor; the lotteries. But having said that, it’s now a matter of national policy. Gambling is good.”

No, that high profile quote is not attributable to a member of the U.S. Congress, a state governor nor other public official or public figure. Most people had no clue who said it until it was published on December 11, 2009 in a Sports Illustrated interview that writer, Ian Thomsen, had with National Basketball Association (NBA) Commissioner, David Stern. In it, Stern reveals that his stance on legalized sports betting has softened.

As such, the prevailing precedent Stern created was his steadfast endorsement of the prohibition of legalized sports betting. And therefore, as he has now seemingly opened Pandora’s Box, if but a crack, his juxtaposition may not be greeted with such warm and fuzzy feelings by the commissioners of the other professional sports leagues as well as the National Collegiate Athletic Association (NCAA).

For it was but a few short months ago, in July 2009, when the NBA joined suit with the National Football League (NFL), Major League Baseball (MLB), the National Hockey League (NHL) and the NCAA in successfully defeating the state of Delaware in its attempt to legalize single game sports betting in its state.

The case in Delaware was based upon the legal theory that the 1992 federal law, known as the Professional and Amateur Sports Protection Act (PASPA) was not applicable to it. In three court appeals, the last requested before the full 12-judge panel of the U.S. 3rd Circuit Court of Appeals, and later denied, found that Delaware was not entitled to offer sports betting a la Las Vegas style sportsbooks sports betting.

So, Delaware had to settle for NFL only 3-game parlay style betting, which links together two or more individual wagers, but is dependent on all of those wagers winning together, in order for the gambler to profit. In addition, all sports bets must be waged solely at Delaware’s race tracks, Dover Downs and Delaware Park. Aside from a hit that the NFL took, however, the other leagues prevailed in winning their case.

In brief, states that offered lottery style or legalized sports betting from 1976-1990 were exempt from the PASPA, and it provided a 1-year grace period for states, who had allowed sports betting over the previous 10-year period, to create legislation permitting sports wagering. Delaware, Oregon, Montana and Nevada had such exemptions. But Delaware did not act within that 1-year period, thus creating its present dilemma.

Since Delaware offered a 3-game parley lottery on NFL games in 1976, it was offered no more than that which it had previously enjoyed.

The leagues, including the NBA, however, played no small role, along with several members of the U.S. Congress, in winning the case. They all appealed to U.S. Attorney General, Eric holder, in their opposition to grandfathering in any sports wagering of any kind. And in the end, Delaware came up short, where its last act would only be to appeal to the U.S. Supreme Court. It does not have any such plans at this time.

Back in 2007, Commissioner Stern agreed to hold the NBA’s 2007 All Star Game in Las Vegas, NV, which remains the only state in the Union which allows single bets to be taken at sportsbooks for every league in professional and college sports and for every team. The only exceptions are the NBA’s Sacramento Kings and the Boston Celtics along with the teams they are playing against on any given day. And such limitations are only with respect to specific casino properties.

The reason for that is that the Palms Hotel and Casino is owned by Joe and Gavin Maloof, who also own the Kings and previously owned the WNBA’s Sacramento Monarchs. The other exception is Harrah’s Entertainment, Inc., which owns a minority interest in the Boston Celtics. As Harrah’s own numerous Las Vegas casino hotels, no sports bets may be taken at those Harrah casinos which have sports books, on Celtics games or their respective opponents, as mandated by the NBA. Prior to 2008, the Palms Casino was not permitted to have sports betting on any NBA teams, but the NBA Board of Governors ruled to allow the Palms to join the rest of the Strip properties, doing so in October 2008.

And during 2007, David Stern had talks with Las Vegas Mayor, Oscar Goodman, regarding the mayor’s interest in acquiring an NBA franchise for his city. But the future looked bleak at that time. Now, the NBA’s Summer League is a fixture there as well as a training ground for USA Basketball and the U.S. Olympic team. And by 2008, Stern had decided to allow the NBA owners to decide whether there will be a future for an NBA club in Las Vegas.

Fast forward to 2009 and Stern now says, “Las Vegas is not evil. Las Vegas is a vacation destination resort and they have sports gambling.” He apparently has come a long way from the 2007 All Star Game when he was adamant about blocking any potential ownership opportunities for his league in Las Vegas. Apparently, the Maloof brothers have done a nice job convincing him otherwise.

The Tim Donaghy referee scandal, also in 2007, put a crimp in Stern’s possible growing interest in a potential marriage with games of chance. At that time, Stern ordered the drafting of new policies with respect to NBA referees’ off-season limit on gambling at legalized casinos. It is now permissible. However, sports betting is off-limits any time of the year. Ironically, Tim Donaghy’s alleged gambling addiction started in legal gambling casinos, now endorsed for NBA referees by David Stern himself.

However, NBA referees are now more closely scrutinized and monitored in their off-court and off-season behaviors, requiring more invasive background and credit checks, while under the employ of the NBA.

And now it makes even more sense as to why Stern would insist that Tim Donaghy was a “rogue” or lone referee with regard to passing on inside information to illegal bookmakers and organized crime syndicates. Yet, both the FBI and the NBA’s own internal investigation found that any of Donaghy’s malfeasances did not alter game outcomes. Still, Donaghy was convicted and served 15 months prison time, including a fine of $500,000.00 and $30,000.00 in required restitution to the NBA.

Assuming that Stern had a grand scheme all along to eventually cash in his chips for a piece of the gambling revenue empire for the NBA, Donaghy merely mucked up the works temporarily, as Stern necessarily went into high gear damage control or virtual denial.

It was by mere coincidence, however, that the FBI even stumbled upon Donaghy, and obviously not through the lax mechanisms in place in Stern’s house, which was neither equipped nor anxious to reveal any corruption in his ranks. An investigation by the federal government into the Gambino Crime Family is what prompted the FBI’s findings; and was flawlessly staged as a complete surprise and seemingly unfathomable to the NBA’s Stern.

And although David Stern might be out of step with the other professional leagues’ commissioners, as concerns legalized sports betting, with the exception of his joining them in the Delaware lawsuit, he is right in line with multi-national corporations, global investors, foreign governments, U.S. state governments and gamblers of all kinds in the U.S. and throughout the world.

If anything, one must agree that David Stern is a master at playing both sides of the fence and therefore may not be as inconsistent as many have criticized him for being, since the Sports Illustrated article broke.

Hypocrite or merely an evolved businessman wanting to cash in his chips, so to speak?

It is estimated that in the U.S. alone, nationalized legal sports betting income taxes and sin taxes could generate over $40 billion over 10 years. And that does not include the take that the NBA would stand to gain from ancillary revenue streams.

With the United Kingdom, Australia, other European entities as well as China in the sports betting business, many in the U.S. Congress, for example, believe legalized sports betting and online gaming would but eliminate illegal off-shore gambling and would be a win-win both for the government and private enterprise, while removing the organized crime quotient.

But whether such comes to pass in the near future, remains to be seen, although cash-strapped states remain hopeful. Yet, in this economy it is anyone’s bet. Yes “gambling is good.” But is it not ultimately about greed?

And the NBA’s appearance of duplicity will continue to have its critics:

“Apparently, the NBA is not as a concerned about the integrity of the league when their teams’ owners’ money is at stake.” – Delaware House Majority Leader Peter C. Schwartzkopf (7/28/09)

Copyright ©2009 Diane M. Grassi

Contact: dgrassi@cox.net

BASEBALL, RAWLINGS BRING NEW MEANING TO FREE TRADE: POSTSCRIPT

By Diane M. Grassi

In 2006, this reporter shed light on the seemingly unfair labor practices taking place in the Central American country of Costa Rica, in a factory operated by the Rawlings Sporting Goods Co., Inc., and now a subsidiary of the multi-national corporation, Jarden Corp. As we embark upon the 2010 Major League Baseball (MLB) season, let us take another look back on this important issue regarding free trade and on that which has transpired since.

At that time, Rawlings was a subsidiary of K2, Inc., primarily a snowboard and in-line skate manufacturer. Then in 2007, Jarden absorbed all of K2’s holdings and Rawlings became one of the many assets of Jarden’s portfolio.

The Jarden Corp.’s holdings, prior to 2007, had primarily been in the consumer household goods industry, such as with Mr. Coffee®, Oster®, Holmes® and CrockPot®. It became pro-active in the purchase of outdoor clothing and camping equipment companies such as ExOfficio and Coleman and then with the purchase of K2, which owned Rawlings, Jarden became a force in the professional sporting goods industry as well.

But much like the way corporate takeovers can surface rapidly and on a global scale, with what appears as little hands-on management, corporations’ goods are then subject to manufacture in far-off lands with little oversight, too. And unfortunately, this accomplished strategy, having culminated primarily over the past 25 years, has enjoyed the muscle and delight of the U.S. government and other state governing bodies of countries throughout the world. Unfortunately, global trade does little to improve the standard of living and human condition of the citizens living in such impoverished countries, where many global giants relocate.

_____________________________________________________

Since this last report, to wit, Costa Rica has become a member of the Dominican Republic-Central American Free Trade Agreement (DR-CAFTA). Costa Rica, the oldest democracy in Central America, held a voters’ referendum in 2007, giving its citizens a voice as to whether they would like to join DR-CAFTA.

The United States Congress rushed through DR-CAFTA in record time, over several months in 2005, but never expected a country such as Costa Rica to actually fight its demands or to obstruct its rush-through process; for all six other CAFTA countries – El Salvador, Honduras, Nicaragua, Guatemala, and the Dominican Republic – were all on board by 2007. As it were, approval for DR-CAFTA was barely passed by Costa Rican voters, and it was not until January 1, 2009 that Costa Rica formally became another Free Trade Zone in Central America.

Few working for or playing in MLB, or for that matter most people living in the U.S., are aware that Free Trade Zones are but a win for the U.S. government and multi-national corporations operating offshore, only. Such corporate entities are not required to pay taxes or tariffs, are allowed to import their supplies duty-free, and electricity and water usage are subsidized. Yet, they are not responsible or required to enforce labor and environmental policies, that would be required had they remained doing business in the U.S.

The following contains parts of the 2006 article, that encapsulates the story of Rawlings Sporting Goods, Inc. and its subsidiary, Rawlings de Costa Rica, S.A., and its manufacture of some 2.2 million baseballs each year made by hand. These laborers work for MLB’s gain, its billionaire owners, and multi-millionaire players, who largely remain mum on this topic to date:

As America’s National Pastime has continued to rake in record high revenues over the past several years – in the billions of dollars each season – MLB continues to remain deaf to its critics concerning the manufacture of its Official Baseball, apparel and other accessories, with regard to unfair labor practices in the Third World.

In 2004, a 60-page report produced by the National Labor Committee (NLC), an international labor rights organization, entitled, Foul Ball, initially exposed the poor working conditions of the Rawlings baseball factory in the remote city of Turrialba, Costa Rica.

MLB had a tepid response to such claims. Then, following the report, life-long consumer advocate, Ralph Nader, wrote a letter to both MLB Commissioner, Bud Selig, and then-Major League Baseball Players Association (MLBPA) Executive Director, Donald Fehr, to address Rawlings’ labor practices. Selig referred Nader’s letter to his legal department and Donald Fehr said he was unaware of such claims. Neither man ever followed up.

In 2005, the United States government entered into the DR-CAFTA, allowing for further tax breaks, duty-free tariffs and Free Trade Zone status for U.S. corporations doing business in Central America, without providing for any policing of unfair labor practices in such offshore locales. Although the Agreement contained language to that effect, there is no enforcement mechanism or political will to instill such.

And instead of it taking the lead in calling-out such a worldwide problem, MLB, through its silence, therefore remains complicit in such exploitation by multi-national corporations throughout the Third World, and especially those that are U.S.-based.

____________________________________________________

The facts are quite stunning as to what goes into the manufacture of a Major League baseball and the sometimes physically debilitating toll workers take in order to produce some 2.2 million balls utilized each MLB season, in addition to the Minor Leagues and the NCAA College World Series, with which the Jarden Corp., on behalf of Rawlings, also exclusively contracts.

Rawlings has been operating its baseball factory out of Costa Rica since 1988, as it gradually transitioned its factories from the country of Haiti, during its period of government unrest in the late 1980’s. Since 1990, Rawlings has produced all of MLB’s baseballs in Costa Rica, with its non-professional baseballs manufactured in China.

Although Rawlings also contracts with the National Football League (NFL) and the National Basketball Association (NBA) in producing some of its balls and accessories, the baseball itself perhaps best symbolizes all-things-American and is therefore worthy of the attention it garners from critics of the Rawlings factory.

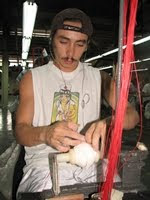

The approximate 600 workers at the baseball factory in Turrialba are either “sewers” who stitch the cowhide covers onto the baseball’s sphere, or they are “assemblers” or “winders”, responsible for assembling the core’s parts, made of two kinds of rubber and cork, and the winding of the ball’s four different grades of yarn. Those who stitch are required to complete 108 stitches into the cowhide leather of each ball by hand.

Each sewer must complete one ball every 15 minutes. They are required to reach a minimum quota of 156 balls per week, in a factory without air conditioning, in temperatures exceeding 100°, requiring permission to use bathrooms, and prohibits workers from speaking to each other on the factory floor. The hours that workers put in average 11 -12 per day and they must always reserve their Saturdays for the factory, in the event an “emergency order” comes through. If not available on Saturday, they are subject to termination.

The gross wages per worker average $1.50 per hour. Workers can earn up to an additional $8.00 per week if they reach the threshold of completing 180 baseballs in one week. Baseball factory workers earn more than the country’s minimum wage but are subject the Costa Rican Labor Ministry for any increases in the minimum wage. Provided they reach the minimum weekly ball quota each week, workers are compensated an additional 25-30 cents per baseball by Rawlings. Should they not reach the minimum quota they again risk being terminated.

The physical impact endured by the sewers has left about one-third of them with carpal tunnel syndrome or repetitive stress injuries, including permanent disability, after just two or three years of stitching. And sadly, most MLB players have no knowledge that every baseball manufactured is done so solely by hand under such conditions. Should a worker miss any length of time greater than a couple of days of work, due to illness or injury, they can be easily replaced due to the desperate employment situation. And their healthcare, thereafter, is in doubt.

___________________________________________________

Costa Rica, always reliant upon its agriculture to sustain its people and to provide jobs, was dependent upon coffee and sugar cane as its main exports. Yet, in the past several years, as prices for coffee in particular rose, a good part its coffee exports, including its sugar cane industry, lost out to Nicaragua, as even cheaper labor costs prevail there. Some labor experts directly blame the impact of DR-CAFTA on the erosion of the agricultural industry in Costa Rica; the opposite of DR-CAFTA’s supposed intent.

Because of the loss of agricultural jobs, the baseball factory now largely sustains the city of Turrialba and its population of 30,000. Rawlings has its workers over a barrel, as they know jobs are scarce, with many more willing to endure such a tough and pressurized work environment.

The NLC as well as the International Labor Committee (ILO) have called upon Rawlings of Costa Rica, S.A. to modify some of its working conditions. Rawlings was asked to provide ergonomics training for workers in order to reduce repetitive stress injuries; to provide workers with a better wage and to increase the amount of incentives based upon levels of production. Yet, Rawlings U.S. deferred to Rawlings de Costa Rica, S.A. and the Costa Rican government.

And the NLC emphasizes the need to allow the workers the right to organize in order to regulate problematic issues, without fear of being fired or reprisal, such as forced overtime or forced layoffs after 3 months, before workers can earn any legal rights. Currently, the workers are well aware that any talk of labor unions will get them dismissed and fear that the factory will go the way of its agricultural industry and relocate to a country where labor is cheaper.

Unfortunately, as the result of doing business abroad, corporations are still subject to the labor laws of the respective country in which they do business. In the case of Costa Rica, there remains a lack of oversight, follow-up or initially filed documents by the Labor Ministry for worker complaints, throughout all industries.

With respect to collective bargaining, it is permissible by law, but is discouraged in the workplace, with employers encouraging workers to join “solidarity associations” instead. These groups are allowed to assemble but are prevented from collective bargaining and are partially financed by the employer.

Ralph Nader previously demanded that MLB and the MLBPA, “Adopt internationally recognized workers’ rights standards and effective enforcement mechanisms, as a core condition governing all of its product sourcing and license agreements.” Yet, much like the U.S. government’s claim it cannot fully enforce its Free Trade Agreements, MLB can make the same claim when it comes to its licensees or subcontractors. Thus, passing the buck becomes an accepted practice and it is chalked it up to the price of doing business in the U.S. and abroad.

Ralph Nader, at the time, went on to say that, “We cannot tell you that it comes as a shock to us that MLB properties do not have any workers’ rights guidelines in their licensing agreements. Nor are we surprised by the irony of the Players Associations’ Strike Fund being supported by royalties from products which might be made by Third World workers stripped of their own rights. The irony is bitter.”

MLB stands pat in that, “Our agreements routinely include provisions that require our partners to comply with applicable laws including those related to employment and workplace safety. At the same time, I am sure you understand that we are not in a position to actively regulate the practices of each and every separate company with which we do business.” No, but they could start with the ball; its centerpiece.

____________________________________________________

It is not too late for MLB and its superstars to take a stand on workers’ rights, regardless of lax U.S. laws in the world of Free Trade and its Agreements’ legal loopholes. And important to note – although it has only been 1 year since DR-CAFTA has been realized in Costa Rica – its exports to the U.S. fell 15%, imports from the U.S. to Costa Rica fell 30%, unemployment rose to 7.8% from 4.9% in 2008 and Foreign Direct Investment from other countries fell approximately 30%. Economists will conveniently blame the global recession on these bleak figures, but it represents many Costa Ricans’ worst nightmares coming true.

The sweatshop culture in the U.S. ended with the enactment of labor laws and the rise of labor unions. However, one must ask that private industry as well as the U.S. government be held accountable. For not only are both culpable in the permanent export of U.S. jobs, but both stand by – eyes wide open – as workers in other countries, without many of the freedoms U.S. citizens enjoy, are blatantly exploited. For there is no “free trade,” as someone ultimately pays.

Take a stand MLB! Perhaps now is the time for Rawlings to go.

Copyright ©2010 Diane M. Grassi

Contact: dgrassi@cox.net